| 2019 ANNUAL MEETING AND PROXY STATEMENT |

2018 PROXY STATEMENT NOTICE OF ANNUAL MEETING OF STOCKHOLDERS WEDNESDAY, APRIL 25, 2018 UNLOCKING VALUE CREATING THREE WORLD-LEADING COMPANIES AGRICULTURE MATERIALS SCIENCE SPECIALTY PRODUCTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted byRule14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material Pursuant to§240.14a-12 | |

DowDuPont Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange ActRules14a-6(i)(1)and0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange ActRule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange ActRule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

| 2019 ANNUAL MEETING AND PROXY STATEMENT |

2018 PROXY STATEMENT NOTICE OF ANNUAL MEETING OF STOCKHOLDERS WEDNESDAY, APRIL 25, 2018 UNLOCKING VALUE CREATING THREE WORLD-LEADING COMPANIES AGRICULTURE MATERIALS SCIENCE SPECIALTY PRODUCTS

NOTICE OF THE ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholder of DowDuPont Inc.:Stockholder:

At the 20182019 Annual Meeting of Stockholders (the “2018“2019 Meeting”), stockholders will vote on the following matters either by proxy or in person:

Date:

Time:

Location:

Wilmington, Delaware 19805 |

Agenda:

1. Election of the

2. Advisory resolution to approve executive compensation.

3.

|

How to Vote

Your vote is important. Whether or not you plan on attending the 20182019 Meeting, please vote your shares as soon as possible by internet, telephone or mail.

| BY INTERNET

www.proxyvote.com |   | BY PHONE

1-800-690-6903 or the number provided on your voting instructions |  | BY MAIL

Use the postage-paid envelope provided |

The Board of Directors of DowDuPont Inc. (the “Board”) has set the close of business on FebruaryApril 26, 2018,2019, as the record date for determining stockholders who are entitled to receive notice of the 20182019 Meeting and to vote.

As permitted by U. S.U.S. Securities and Exchange Commission (the “SEC”) rules, proxy materials were made available via the internet. Notice regarding availability of proxy materials and instructions on how to access those materials were mailed to certain stockholders of record on or about March 16, 2018April 29, 2019 (the “Notice”). The instructions included how to vote online and how to request a paper copy of the proxy materials. This method of notice and access gives the Company a lower-cost way to furnish stockholders with their proxy materials.

Proof of stock ownership is necessary to attend the 20182019 Meeting. Since seating is limited, the Board has established the rule that only stockholders or one person holding a proxy for any stockholder or account (in addition to those named as Board proxies on the proxy forms) may attend. Please see page 2 of the Proxy Statement for information on attending the 2018 Meeting.

If you are unable to attend the 2018 Meeting in person, please listen to the live audio webcast or the replay after the event, atwww.dow-dupont.com/investors.person.

Thank you for your continued support and your interest in DowDuPont Inc.

Stacy Fox

General Counsel and Secretary

March 16, 2018April 29, 2019

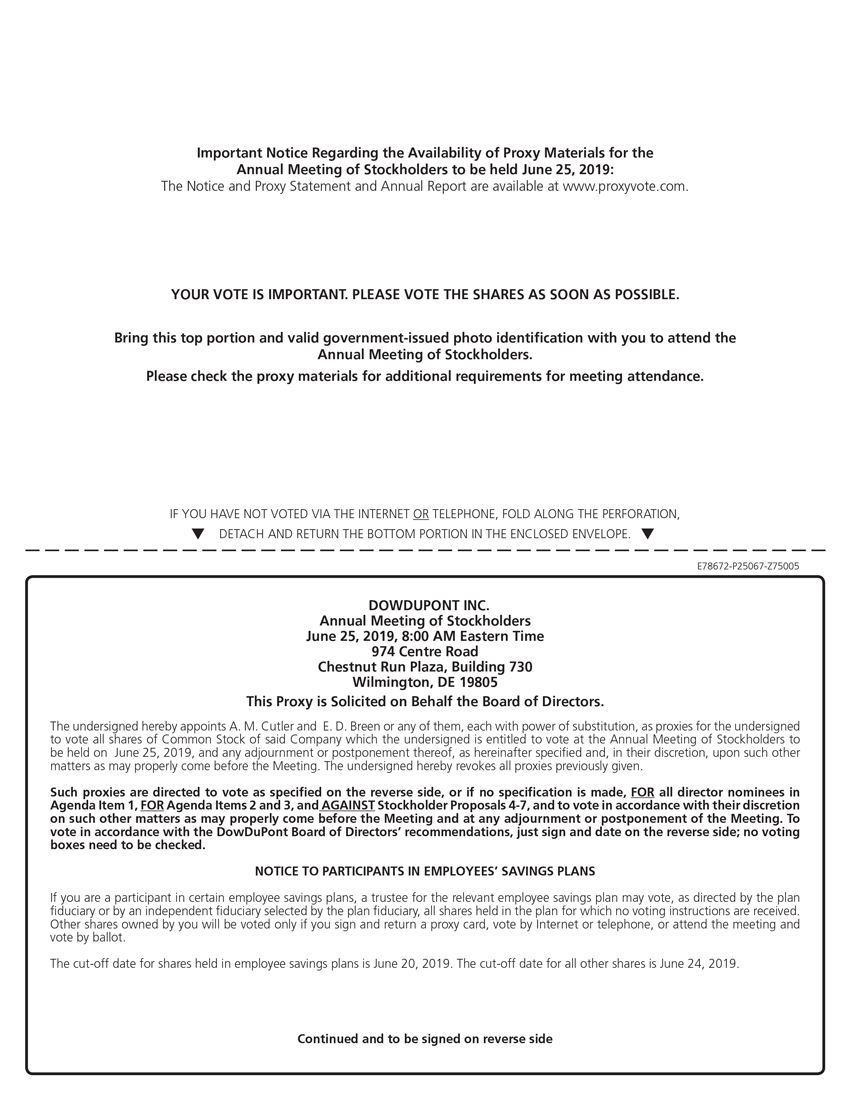

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON APRILJUNE 25, 20182019

The Notice and Proxy Statement and Annual Report are available at www.proxyvote.com.www.proxyvote.com.

ABOUT THE DOWDUPONT MERGER TRANSACTION AND INTENDED BUSINESS SEPARATIONS

Effective August 31, 2017, The Dow Chemical Company (“Dow”) and E. I. du Pont de Nemours and Company (“DuPont”) completed the previously announced merger of equals transaction contemplated by the Agreement and Plan of Merger dated as of December 11, 2015, as amended on March 31, 2017 (the “Merger Transaction”). The Merger Transaction resulted in each of Dow and DuPont surviving as subsidiaries of DowDuPont Inc. (“DowDuPont”). For purposes of this Proxy Statement, references to “the Company” refer to DowDuPont.

Each share of common stock of Dow was converted into the right to receive one fully paid andnon-assessable share of common stock of the Company. Each share of common stock of DuPont was converted into the right to receive 1.2820 fully paid andnon-assessable shares of common stock of the Company. Any shares of common stock of Dow and DuPont which were held in treasury immediately prior to the Merger Transaction were automatically cancelled and retired for no consideration.

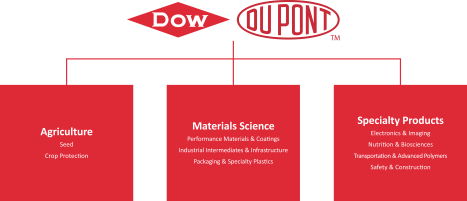

DowDuPont is now pursuing the intended separation of the Company’s Agriculture, Materials Science and Specialty Products divisions into three independent, publicly traded companies (the “Intended Business Separations”). The Intended Business Separations, which are subject to Board approval, are expected to be in the form ofpro-rataspin-off transactions, under which DowDuPont stockholders will receive shares of capital stock in the resulting companies. DowDuPont recently announced dates for the Intended Business Separations: Materials Science is expected to separate from DowDuPont by the end of the first quarter of 2019, and Agriculture and Specialty Products are each expected to separate from one another by June 1, 2019.

DowDuPont recently announced brand names for the Intended Business Separations reflecting its ongoing progress toward the separations.

Dow was determined to be the accounting acquirer in the Merger Transaction and, as a result, certain historical information of Dow is presented in this Proxy Statement for the periods prior to the Merger Transaction. A further description of the Merger Transaction can be found in the current report on Form8-K filed by DowDuPont on September 1, 2017.

| ||||||||

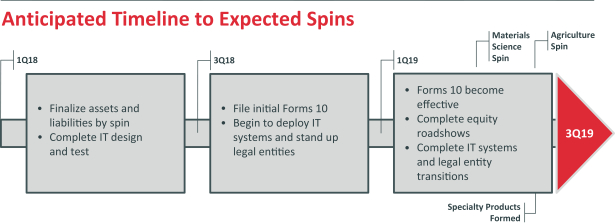

Anticipated Timeline to Expected Spins 1Q18 3Q18 1Q19 MatCo Spin AgCo Spin Finalize assets and liabilities by spin Complete IT design and test File initial Forms 10 Begin to deploy IT systems and stand up legal entities Forms 10 become effective Complete equity roadshows Complete IT systems and legal entity transitions 3Q19 SpecCo Formed

THREE INDUSTRY-LEADING COMPETITORS WITH STRONG FOUNDATIONS

FOR INDEPENDENT, SUSTAINABLE GROWTH

We expect to complete the separation of the Materials Science division from DowDuPont by the end of first quarter of 2019, and the separation of the Agriculture and Specialty Products divisions from one another by June 1, 2019.

|

|

The intended Agriculture company will become Corteva Agriscience™ and will bring together the strengths of DuPont Pioneer, DuPont Crop Protection and Dow AgroSciences to form a pure-play Agriculture company with the industry’s most comprehensive and balanced portfolio, focused resources, and the scale needed to deliver the innovative solutions its customers need. The highly productive innovation engine and combined robust pipeline of solutions across seed, crop protection, seed-applied technologies, and digital agriculture will enable the intended Agriculture company to bring a broader suite of products to the market faster and be an even better partner to farmers around the world, helping them to increase their productivity and profitability.

|

|

The intended Materials Science company will be called Dow and will be the premier materials science solution provider, focused on three, high-growth market verticals: packaging, infrastructure and consumer care. Built on a foundation of the strongest and deepest chemistry and polymers toolkit, the intended Materials Science company will have robust technology and asset integration, scale and cost-competitive capabilities to enable truly differentiated and sustainable solutions for customers.

|

| |

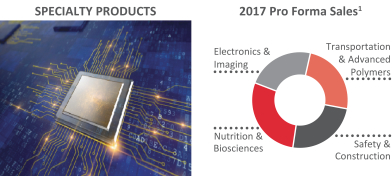

The intended Specialty Products company will be the new DuPont and will be a premier innovation leader composed of technology-based differentiated materials, ingredients and solutions that transform multiple industries and everyday life. It will apply its market knowledge and deep expertise in science and application development to solve customer needs in attractive markets and accelerate the adoption of electronic functionality and biotechnology into consumer and industrial applications. Bringing together science and market insights, Specialty Products will be well positioned for growth opportunities where customer collaboration and innovation are central to value creation.

| ||||||||

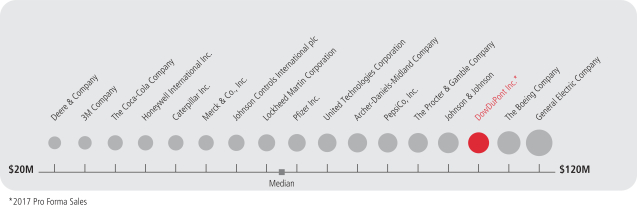

AGRICULTURE MATERIALS SCIENCE SPECIALTY PRODUCTS 2017 Pro Forma Sales1 2017 Pro Forma Sales1 2017 Pro Forma Sales1 Crop Protection Seed Packaging & Specialty Plastics Industrial Intermediates & Infrastructure Performance Materials & Coatings Electronics & Imaging Transportation & Advanced Polymers Nutrition & Biosciences Safety & Construction

Cautionary Statement About Forward-Looking Statements

This communicationproxy statement contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” and similar expressions and variations or negatives of these words.

Forward-looking statements by their nature address matters that are, to varying degrees, uncertain, including statements about the intended separation, subject to approvaldistribution of all of the Company’s Boardshares of Directors,common stock of DowDuPont’s Agriculture, Materials Science and Specialty Products businesses in one or more tax efficient transactions on anticipated termswholly-owned subsidiary, Corteva, Inc. (the “Intended Business Separations”“Corteva Distribution”). Forward-looking statements, including those related to the DowDuPont’s ability to complete, or to make any filing or take any other action required to be taken to complete, the Corteva Distribution, are not guarantees of future performanceresults and are based on certainsubject to risks, uncertainties and assumptions and expectations of future events which may not be realized.that could cause actual results to differ materially from those expressed in any forward-looking statements. Forward-looking statements also involve risks and uncertainties, many of which that are beyond the Company’sDowDuPont’s control. Some of the important factors that could cause DowDuPont’s Dow’s or DuPont’s actual results to differ materially from those projected in any such forward-looking statements include, but are not limited to: (i) ability and costs to achieve all the expected benefits from the Corteva Distribution and achieving the successful integrationApril 1, 2019 distribution by DowDuPont of all of the respective Agriculture, Materials Science and Specialty Products businessesshares of common stock of Dow Inc. on a pro rata basis to the holders of DowDuPont common stock (the “Dow Distribution”); (ii) restrictions under intellectual property cross license agreements entered into or to be entered into in connection with the Corteva Distribution and DuPont, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, productivity actions, economic performance, indebtedness, financial condition, losses, future prospects, businessthe Dow Distribution; (iii) ability to receive third-party consents required under the separation agreement entered into in connection with the Corteva Distribution and management strategies for the management, expansionDow Distribution;(iv) non-compete restrictions under the separation agreement entered into in connection with the Corteva Distribution and growththe Dow Distribution; (v) the incurrence of significant costs in connection with the Corteva Distribution and the Dow Distribution, including increased costs from supply, service and other arrangements that prior to the Dow Distribution were between entities under the common control of DowDuPont; (vi) risks outside the control of DowDuPont which could impact the decision of the combined operations; (ii) costsDowDuPont Board of Directors to achieveproceed with the Corteva Distribution, including, among others, global economic conditions, instability in credit markets, declining consumer and achievementbusiness confidence, fluctuating commodity prices and interest rates, volatile foreign currency exchange rates, tax considerations, other challenges that could affect the global economy, specific market conditions in one or more of the anticipated synergies byindustries of the combined Agriculture, Materials Sciencebusinesses proposed to be separated, and Specialty Products businesses; (iii) risks associatedchanges in the regulatory or legal environment and the requirement to redeem $12.7 billion of DowDuPont notes if the Corteva Distribution is abandoned or delayed beyond May 1, 2020; (vii) potential liability arising from fraudulent conveyance and similar laws in connection with the Intended Business Separations, including conditions which could delay, preventCorteva Distribution and/ or otherwise adversely affect the proposed transactions, including possible issues or delays in obtaining required regulatory approvals or clearances related to the Intended Business Separations, associated costs, disruptions in the financial markets or other potential barriers; (iv)Dow Distribution; (viii) disruptions or business uncertainty, including from the Intended Business Separations,Corteva Distribution, could adversely impact DowDuPont’s business (either directly or as conducted by and through Dow or DuPont), or financial performance and its ability to retain and hire key personnel; (v)(ix) uncertainty as to the long-term value of DowDuPont common stock; (x) potential inability to access the capital markets; and (vi)(xi) risks to DowDuPont’s Dow’s and DuPont’s business, operations and results of operations from: the availability of and fluctuations in the cost of energyfeedstocks and feedstocks;energy; balance of supply and demand and the impact of balance on prices; failure to develop and market new products and optimally manage product life cycles; ability, cost and impact on business operations, including the supply chain, of responding to changes in market acceptance, rules, regulations and policies and failure to respond to such changes; outcome of significant litigation, environmental matters and other commitments and contingencies; failure to appropriately manage process safety and product stewardship issues; global economic and capital market conditions, including the continued availability of capital and financing, as well as inflation, interest and currency exchange rates; changes in political conditions, including trade disputes and retaliatory actions; business or supply disruptions; security threats, such as acts of sabotage, terrorism or war, natural disasters and weather events and patterns which could result in a significant operational event for the Company,DowDuPont, adversely impact demand or production; ability to discover, develop and protect new technologies and to protect and enforce the Company’sDowDuPont’s intellectual property rights; failure to effectively manage acquisitions, divestitures, alliances, joint ventures and other portfolio changes; unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as management’s response to any of the aforementioned factors. These risks are and will be more fully discussed in theDowDuPont’s current, quarterly and annual reports filedand other filings made with the U.S. Securities and Exchange Commission by DowDuPont.(the “SEC”), as may be amended from time to time in future filings with the SEC. While the list of factors presented here is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on DowDuPont’s Dow’s or DuPont’sCorteva, Inc.’s consolidated financial condition, results of operations, credit rating or liquidity. NoneYou should not place undue reliance on forward-looking statements, which speak only as of the date they are made. DowDuPont Dow or DuPont assumes anyno obligation to publicly provide revisions or updates to any forward-looking statements whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. A detailed discussion of some of the significant risks and uncertainties which may cause results and events to differ materially from such forward-looking statements is included in the section titled “Risk Factors” (Part I, Item 1A1A) of DowDuPont’s 20172018 Annual Report onForm10-K). 10-K as may be modified by DowDuPont’s 2019 quarterly reports on Form 10-Q and current reports on Form 8-K.

| i | |||||||

Annual Meeting of Stockholders

| Date and Time | Place | Record Date | ||

|

Wilmington, Delaware 19805 |

Meeting Agenda and Voting Recommendations

|

| |||||||||

|

| |||||||||

1:

|

|

FOR EACH NOMINEE |

| 13

| ||||||

| ADVISORY RESOLUTION

| FOR

|

| 57

| ||||||

| RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

| FOR | ||||||||

|

| 58 | ||||||||

| 4: | AGAINST | 62 | ||||||||

| 5: | STOCKHOLDER PROPOSAL – PREPARATION OF AN EXECUTIVE COMPENSATION REPORT

| AGAINST | 64 | |||||||

| STOCKHOLDER PROPOSAL –

| AGAINST | 66 | |||||||

| STOCKHOLDER PROPOSAL –

| AGAINST | ||||||||

|

| 68 | ||||||||

This summary highlights information contained elsewhere in this Proxy Statement. It does not contain all information that you should consider, and you should read the entire Proxy Statement carefully before voting.

| ii |   | |||||||

PROXY STATEMENT SUMMARY (continued)

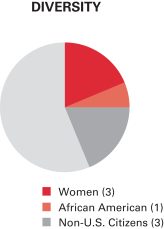

Board Nominees

Each Director nominee is elected annually by a majority of votes cast to serve for a one-year term that expires at the Annual Meeting in 2019 or until their successors are elected and qualified. While nominated for re-election, the Company has announced that Mr. Liveris will serve as a Director of DowDuPont only through July 1, 2018, at which time he will retire from the Company and the Board of Directors. As set forth in the Bylaws, the Continuing Dow Directors will identify a replacement to fill the vacancy at that time. The following table provides summary information about each Director nominee. The information is current as of the date of this Proxy Statement and the age listed is as of the 2018 Meeting.

Overview of Business

DowDuPont Merger TransactionExecutive Summary

Effective August 31, 2017, The Dow Chemical Company and its consolidated subsidiaries (“Historical Dow”) and E. I. du Pont de Nemours and Company and its consolidated subsidiaries (“Historical DuPont”) completed the previously announced merger of equals transaction contemplated by the Agreement and Plan of Merger dated as of December 11, 2015, as amended on March 31, 2017 (the “Merger Transaction”). The Merger Transaction resulted in each of Historical Dow and Historical DuPont surviving as subsidiaries of DowDuPont Inc. (“DowDuPont”). For purposes of this Proxy Statement, references to “the Company” refer to DowDuPont.

Dow was determined to be the accounting acquirer inFollowing the Merger Transaction, and, as a result, certain historical information of Dow is presented in this Proxy Statement for the periods priorDowDuPont began taking steps to the Merger Transaction. A further description of the Merger Transaction can be found on page i of the Proxy Statement and in the current report onForm 8-K filed by DowDuPont on September 1, 2017.

DowDuPont is now pursuing the intended separation of the Company’s Agriculture, Materials Science and Specialty Products divisionsseparate into three, independent, publicly traded companies - one for each of its agriculture, materials science and specialty products businesses (the “Intended Business Separations”). The and the transactions to accomplish the Intended Business Separations, the “separations”). Dow Inc. (“Dow”) was formed as a wholly owned subsidiary of DowDuPont to serve as the holding company for the materials science business and Corteva Inc. (“Corteva”) was formed as a wholly owned subsidiary of DowDuPont to serve as the holding company for the agriculture business.

The separation of Dow was completed on April 1, 2019 when DowDuPont stockholders received a pro rata dividend of all of the outstanding shares of common stock of Dow (the “Dow Distribution”). DowDuPont expects to complete the separation and distribution of Corteva on June 1, 2019 through a pro rata dividend of the shares of the capital stock of Corteva (the “Corteva Distribution” and, together with the Dow Distribution, the “distributions”). Following the distributions, DowDuPont will continue to hold the specialty products business, expects to change its corporate name to DuPont de Nemours Inc. and will become known as DuPont. References to “DuPont” in this Proxy Statement refer to the Company after the consummation of the Corteva Distribution.

DowDuPont intends to complete a reverse stock split to increase the market price of its common stock in connection with the Corteva Distribution. DowDuPont will hold a special meeting of stockholders at which are subjectstockholders will be asked to vote on a proposal to adopt and approve the reverse stock split to reflect a ratio of not less than2-for-5 and not greater than1-for-3, with the exact ratio to be determined by the Board approval,(the “Reverse Stock Split”). DowDuPont will provide stockholders with a separate proxy statement in connection with the matters to be voted on at the special meeting. This Proxy Statement does not relate to the special meeting and only relates to the items of business described herein which are expected to be considered at the 2019 Meeting.

The Proxy Statement contains certain information regarding the year ended December 31, 2018, including information with respect to director and executive compensation and certain other matters, as required by the rules and regulations of the SEC. The 2018 information presented in the formProxy Statement is information for DowDuPont and does not give effect to the Dow Distribution or the intended distribution ofpro-rataspin-off transactions, under which DowDuPont stockholders will receive shares Corteva. The Proxy Statement also includes information as of capital stockthe record date for the 2019 Meeting and as of the date hereof. All information as of the record date and as of the date hereof presented in the resulting companies. DowDuPont recently announced dates forProxy Statement gives effect to the Intended Business Separations: Materials Sciencecompletion of the Dow Distribution, but does not give effect to the distribution of Corteva, which will be called Dow, is expected to separate from DowDuPont byoccur after the enddate hereof and prior to the date of the first quarter of 2019 and Agriculture,Meeting. Finally, the Proxy Statement includes certain information with respect to DuPont which will become Corteva Agriscience™, and Specialty Products, which will be the new DuPont, are each expected to separate from one another by June 1, 2019.

DowDuPont is led by a management team that reflects the strengths and capabilities of both Dow and DuPont. Each of the three divisions leads its respective industry through productive, science-based innovation to meet the needs of customers and help solve global challenges.

| ||||||||

Lamberto Andreotti Age: 67 Independent Director Since: 2012 Legacy: DuPont James A. Bell Age: 69 Independent Director Since: 2005 Legacy: Dow Edward D. Breen Age: 62 Director Since: 2015 Legacy: DuPont Robert A. Brown Age: 66 Independent Director Since: 2007 Legacy: DuPont Alexander M. Cutler Age: 66 Independent Director Since: 2008 Legacy: DuPont Jeff M. Fettig Age: 61 Independent Director Since: 2003 Legacy: Dow Marillyn A. Hewson Age: 64 Independent Director Since: 2007 Legacy: DuPont Lois D. Juliber Age: 69 Independent Director Since: 1995 Legacy: DuPont Andrew N. Liveris Age: 63 Director Since: 2004 Legacy: Dow Raymond J. Milchovich Age: 68 Independent Director Since: 2015 Legacy: Dow Paul Polman Age: 61 Independent Director Since: 2010 Legacy: Dow Dennis H. Reilley Age: 65 Independent Director Since: 2007 Legacy: Dow James M. Ringler Age: 72 Independent Director Since: 2001 Legacy: Dow Ruth G. Shaw Age: 70 Independent Director Since: 2005 Legacy: Dow Lee M. Thomas Age: 73 Independent Director Since: 2011 Legacy: DuPont Patrick J. Ward Age: 54 Independent Director Since: 2013 Legacy: DuPont

PROXY STATEMENT SUMMARY (continued)

The management team seeks to deliver value at DowDuPont through:

Performance Highlights

Meeting.

See Appendix A for a reconciliation to the most directly comparable U.S. GAAP financial measures.

| ||||||||

Agriculture Materials Science Specialty Products Crop Protection Seed Packaging & Specialty Plastics Industrial Intermediates & Infrastructure Performance Materials & Coatings Electronics & Imaging Transportation & Advanced Polymers Nutrition & Biosciences Safety & Construction

PROXY STATEMENT SUMMARY (continued)

Corporate Governance Best Practices2018 Performance Highlights

| • | 2018 GAAP earnings per share from continuing operations totaled $1.65. Adjusted earnings per share* was $4.11, up 21 percent versus pro forma results in 2017. Adjusted earnings per share excludes significant items totaling net charges of $2.02 per share, as well as a $0.44 per share charge for Historical DuPont amortization of intangible assets. |

| • | 2018 GAAP net sales increased 38 percent. Net sales increased 8 percent to $86.0 billion versus pro forma results in 2017, with gains in all regions. |

| • | 2018 GAAP Net Income from Continuing Operations totaled $4.0 billion. Operating EBITDA* increased 13 percent to $18.3 billion versus pro forma results in 2017, as cost synergies; local price gains; volume growth, including the benefit of new capacity additions; lower pension/OPEB costs; and higher equity earnings more than offset higher raw material costs. |

| • | Net income available for common stockholders was $3,844 million ($1.65 per share) in 2018, compared with $1,460 million ($0.91 per share) in 2017. |

| • | In 2018, Historical Dow and Historical DuPont each made discretionary contributions of $1,100 million to their respective principal U.S. pension plans. On November 1, 2018, the Company announced a new $3.0 billion share buyback program, which expired on March 31, 2019 - commensurate with the expected timing of the materials sciencespin-off. At December 31, 2018, the Company had repurchased $1.4 billion of shares under this program. |

| • | On November 1, 2018, the Company increased its cost synergy target under the DowDuPont Synergy Program to $3.6 billion. DowDuPont achieved year-over-year cost synergy savings of $1.6 billion. |

| • | Cash flow from operations totaled $4.7 billion in 2018 and included discretionary pension contributions of approximately $2.2 billion. Excluding these discretionary contributions, cash flow from operations would have been $6.9 billion in 2018. |

| • | The Company completed steps to establish the initial capital structure of Dow, Corteva and DuPont, including the issuance of $12.7 billion of senior unsecured notes by the Company. |

| * | See Appendix A for a reconciliation to the most directly comparable U.S. GAAP financial measures. |

| iv |  | |||||||

As part of DowDuPont’s commitment

PROXY STATEMENT SUMMARY (continued)

Director Nominees

You are being asked to high ethical standards, the Board follows sound governance practices. These practices are described in more detail beginning on page 3 of the Proxy Statement andvote on the Company’s website atwww.dow-dupont.com/investors/corporate-governance.election of 12 directors. All directors are elected annually. Detailed information about each Director’s background, skills and expertise can be found inProposal 1 — Election of Directors. The committee memberships referenced in the following table reflect the expected committee composition following the Corteva Distribution.

(As of the date of the Proxy) Name Age Current Position | Independent | Audit Committee | Nomination Governance Committee | People and Committee | Sustainability, Health & Safety Committee | Other Current Public Boards | ||||||||||||||||||

Edward D. Breen | ||||||||||||||||||||||||

Age 63 Chair and Chief Executive Officer, DowDuPont | 1 | |||||||||||||||||||||||

Ruby R. Chandy | ||||||||||||||||||||||||

Age 57 Chief Executive Officer & President, Lumina Advisory Services | X | X | CH | 2 | ||||||||||||||||||||

Franklin K. Clyburn, Jr. | ||||||||||||||||||||||||

Age 54 EVP, Chief Commercial Officer, Merck | X | X | X | |||||||||||||||||||||

Terrence R. Curtin | ||||||||||||||||||||||||

Age 50 Chief Executive Officer, TE Connectivity | X | X | X | 1 | ||||||||||||||||||||

Alexander M. Cutler | ||||||||||||||||||||||||

Age 67 Retired Chair and Chief Executive Officer, Eaton | X | CH | X | 1 | ||||||||||||||||||||

C. Marc Doyle | ||||||||||||||||||||||||

Age 50 Chief Operating Officer, Specialty Products Division, DowDuPont | ||||||||||||||||||||||||

Eleuthère I. du Pont | ||||||||||||||||||||||||

Age 52 President, Longwood Foundation | X | X | X | |||||||||||||||||||||

Rajiv L. Gupta | ||||||||||||||||||||||||

Age 73 Chairman of Aptiv, PLC | X | CH | X | 3 | ||||||||||||||||||||

Luther C. Kissam | ||||||||||||||||||||||||

Age 54 Chair, President & Chief Executive Officer, Albemarle Corp. | X | X | X | 1 | ||||||||||||||||||||

Frederick M. Lowery | ||||||||||||||||||||||||

Age 48 SVP, Thermo Fisher, President Life Sciences and Laboratory Products Groups | X | X | X | |||||||||||||||||||||

Raymond J. Milchovich | ||||||||||||||||||||||||

Age 69 Former Chair and Chief Executive Officer, Foster Wheeler AG | X | X | X | |||||||||||||||||||||

Steven M. Sterin | ||||||||||||||||||||||||

Age 47 Former EVP & Chief Financial Officer, Andeavor | X | CH | X | |||||||||||||||||||||

CH = Chair

| v | |||||||

PROXY STATEMENT SUMMARY (continued)

Corporate Governance Best Practices

As part of DowDuPont’s commitment to high ethical standards, the Board follows sound governance practices. These practices, which are summarized below, are described in more detail beginning on page 3 of the Proxy Statement and on the Company’s website atwww.dow-dupont.com/investors/corporate-governance.

Board Independence | Director Elections | Board Practices | Stock Ownership | Stockholder Rights | ||||||||||||||||||||

Director

independent

| Annual Board elections

Directors are elected by a majority of votes cast

Directors not elected by a majority of votes cast are subject to the resignation policy | Non-employee executive session without management at each

Annual Board and Committee evaluations

Director orientation programs | Non-employee

Directors are required to with stock ownership guidelines Directors are

retirement

Executives and prohibited from Company stock

| Stockholder right to callspecial meetings (with a 25% ownership threshold)

stockholder voting

Eligible

proxy access |

Company Leadership and Board Composition

Company Leadership

In order to ensure that DowDuPont benefited from the experience and expertise of both Dow’s and DuPont’s leadership teams and Directors, it was determined priorPrior to the Merger Transaction that Andrew N. Liveris, Chairman and CEOcompletion of the Dow would serveDistribution on April 1, 2019, Jeff Fettig served as the Executive Chairman of DowDuPontthe Board and Edward D. Breen Chairman and CEO of DuPont, would serveserved as the Chief Executive Officer of DowDuPont. In connection with the Dow Distribution, Mr. Fettig resigned from the Board of DowDuPont and became thenon-executive chairman of Dow. Following the Dow Distribution, Mr. Breen was appointed as the Chair and Chief Executive Officer of DowDuPont. Following the Corteva Distribution, Mr. Breen will serve as the Executive Chair of DuPont and Marc Doyle, currently chief operating officer of the Specialty Products Division, will be Chief Executive Officer of DuPont.

| vi |  | |||||||

PROXY STATEMENT SUMMARY (continued)

Board Composition and Director Experience

Additionally, in order to ensure effective oversightAs of DowDuPont,the date of the Proxy Statement the Board consistswas composed of sixteen Directors; eightthe Directors listed below. As indicated in the table, certain of whom werethe current Directors are expected to resign in connection with the Corteva Distribution and become directors of Corteva and certain of the current Directors are expected to continue as Directors of DuPont and are nominated forre-electionat Dowthe 2019 Meeting.

| Expected Board Affiliation Following Corteva Distribution | ||||

Current DowDuPont Directors | Corteva | DuPont | ||

Lamberto Andreotti | X | |||

Edward D. Breen | X | X | ||

Robert A. Brown | X | |||

Alexander M. Cutler | X | |||

Lois D. Juliber | X | |||

Lee M. Thomas | X | |||

Patrick J. Ward | X | |||

Following the Corteva Distribution and prior to the closing of2019 Meeting, the Merger Transaction (including Andrew N. Liveris and Jeff M. Fettig, former Lead Independent Director) and eight of whom were Directors at DuPont priorfollowing individuals are expected to be appointed to the closingBoard of DuPont (prior to the Merger Transaction (including Edward D.Corteva Distribution, DowDuPont): Ruby R. Chandy, Franklin K. Clyburn, Jr., Terrence R. Curtin, C. Marc Doyle, Eleuthère I. du Pont, Rajiv L. Gupta, Luther C. Kissam, Frederick M. Lowery, Raymond J. Milchovich and Steven M. Sterin (collectively, the “New DuPont Directors”). Mr. Milchovich previously served on the DowDuPont Board from September 1, 2017 until July 1, 2018. These ten directors, as well as Messrs. Breen and Alexander M. Cutler, former Lead Independent Director). will stand forre-election at the 2019 Meeting.

The Directors collectively possess a variety of skills, professional experience, and diversity of backgrounds that allow them to

| ||||||||

PROXY STATEMENT SUMMARY (continued)

effectively oversee DowDuPont’s business including: leadership experience, international experience, operational experience in a variety of relevant fields and industries, public company board experience, board or other significant experience with academic research and philanthropic institutions and trade and industry organizations, and prior government or public policy experience. Each Director’s relevant experiences

ExecutiveCompensation

Compensation of the executive officers of DowDuPont is overseen by the People and attributes collectively provideCompensation Committee (or, in the Boardcase of both the former Executive Chairman and the CEO, by the Compensation Committee and the independent members of the Board). For 2018 compensation decisions, the Compensation Committee delegated certain responsibilities relating to the compensation and benefits provided to employees of Historical Dow and Historical DuPont to the Historical Dow Compensation Subcommittee and the Historical DuPont Compensation Subcommittee respectively, with a balancethe exception of perspectives that contribute to its effectivenessthe Executive Officers of DowDuPont, in overseeingwhich case oversight remained with the business, preparing forCompensation Committee and the Intended Business Separations, and advising the Company on navigating the regulatory environment for the Intended Business Separations.

Board Committees

Board. The Board, maintains an Audit Committee;the Compensation Committee; Corporate Governance Committee and Environment, Health, Safety and Technology Committee (the “Standing Committees”). In addition to the Standing Committees, three Advisory Committeesrespective Subcommittees were established to oversee the business and affairsassisted in performance of each of DowDuPont’s Agriculture, Materials Science and Specialty Products divisions in preparation for the Intended Business Separations. Each Advisory Committee is responsible for overseeing their respective divisions. The responsibilities of each Standing Committee and Advisory Committee are stated in the Bylaws as well as in their respective charters. The Committees are described in more detail beginning on page 4 of the Proxy Statement.

A list of the Directors and their respective Committee memberships is below:

|

|

|

|

| ||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

* = Independent CH = Chairman or, as applicable,Co-Chairman A = Additional Ex Officio Attendee

In addition, Advisory Committee members may participate in other Advisory Committee meetings as an attendee. Such attendees may not vote or be counted for quorum purposes. Advisory Committees also include ex officio members from the legacy Dow and legacy DuPont Boards who are not serving on the Board, as well as additional members who participate in an ex officio capacity as appointedoversight duties by the Board to provide the Advisory Committees with the business context and knowledge needed to ensure an efficient and timely transition for the Intended Business Separations. Such ex officio members may not vote or be counted for quorum purposes.independent compensation consultants.

| ||||||||

PROXY STATEMENT SUMMARY (continued)

ExecutiveCompensation

Program Structure and Alignment with Core Principles

Both Dow and DuPont have a history of designingThe following summarizes key governance characteristics related to the executive compensation programs to attract, motivate, reward and retainin which the high-quality executives necessary for Company leadership and strategy execution. This legacy continues at DowDuPont and positions the Company well in order to deliver on the commitment to create three independent, industry-leading companies.

The legacy Dow and DuPont compensation programs are designed and administered to follow these core principles:

DowDuPont is focused on implementing pay practices to ensure continued alignment with the Company’s core principles. The following summarizes DowDuPont’s keynamed executive compensation governance practices:officers participate:

KEY EXECUTIVE COMPENSATION PRACTICES

|

✓ Active stockholder engagement

✓ Strong links between executive compensation outcomes and company financial and market performance

✓

✓ Significant focus on performance-based pay

✓ Each component of target pay benchmarked with respect to

✓ Carefully structured peer group with regular Compensation Committee review

✓ Stock ownership requirements of six times base salary for the

✓ 100% independent Compensation Committee

✓ Clawback policy

✓ Anti-hedging/Anti-pledging policies

✓ Independent compensation consultants reporting to the Compensation Committee

✓ No new single-trigger change in control agreements

✓ Stock incentive plans prohibit option repricing, reloads, exchanges or options granted below market value without stockholder approval

✓ Regular review of the Compensation Committee Charter to ensure best practices and priorities

|

As implementationFollowing the Dow Distribution and the Corteva Distribution, the future compensation committees of the Intended Business Separations continues, the Compensation Committee will continueeach of Dow, Corteva and DuPont are expected to review best practices in governance and modify the executive compensation structures applicable to ensure that the compensation programs align with the Company’s core principles.each company.

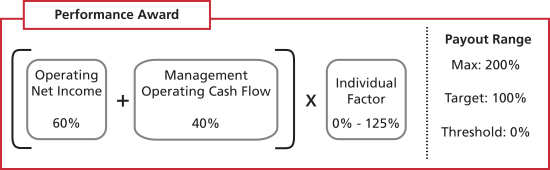

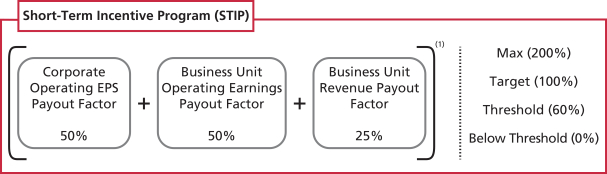

Executive Compensation Program Summary

2017 was a unique year, as both Dow and DuPont operated as standalone companies prior to the Merger Transaction, each with its own executive compensation and benefit programs and practices. Given the Intended Business Separations within a relatively short period of time after the closing of the Merger Transaction, a decision was made not to not develop separate executive compensation programs at the DowDuPont level for 2017. Rather, the executive officers of DowDuPont continue to be employees of, and participants in, the compensation and benefit programs of Dow and DuPont, respectively. The only exception to this structure is related to a post-merger grant of Performance Share Units (“PSUs”) which were awarded to certain senior executives and which is discussed more fully in the section entitled “DowDuPont – Post Merger Grant” which can be found on page 45 of the Proxy Statement.

| ||||||||

PROXY STATEMENT SUMMARY (continued)

level. Each of the Historical Dow and Historical DuPont executive compensation programs delivers value through three primary forms of compensation: base salary, annual incentives, and long-term incentives. The compensation outcomes under the programs’ annual and long-term incentives are determined by respective company performance (and, in the case of the post-merger PSUs awarded, by the overall performance of DowDuPont).

The following table summarizes the two companies’ respective 2017 legacy executive compensation programs.

| ||||

|

|

| ||

| ||||

|

| |||

|

| |||

The following merger-related compensation actions were taken in 2017:

| viii |   | |||||||

2018

2019 Annual Meeting of Stockholders

DowDuPont Inc.

| ||||||||

| ||||||||

| x |  | |||||||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON APRILJUNE 25, 20182019

The Notice and Proxy Statement and Annual Report are available at www.proxyvote.com.

Stockholders may request their proxy materials be delivered to them electronically in 20192020 by visiting

https://enroll.icsdelivery.com/dwdp.dwdp.

The Proxy Statement contains certain information regarding the year ended December 31, 2018, including information with respect to director and executive compensation and certain other matters, as required by the rules and regulations of the SEC. The 2018 information presented in the Proxy Statement is information for DowDuPont and does not give effect to the Dow Distribution or the intended distribution of Corteva. The Proxy Statement also includes information as of the record date for the 2019 Meeting and as of the date hereof. All information as of the record date and as of the date hereof presented in the Proxy Statement gives effect to the completion of the Dow Distribution, but does not give effect to the distribution of Corteva, which is expected to occur after the date hereof and prior to the date of the 2019 Meeting. Finally, the Proxy Statement includes certain information with respect to DuPont which is expected to be the remaining business of the Company after the completion of the distributions and as of the date of the 2019 Meeting.

VOTING AND ATTENDANCE PROCEDURES

In this Proxy Statement, you will find information on the Board of Directors of DowDuPont Inc. (the “Board”), the candidates for election to the Board, and eightsix other items to be voted upon at the 20182019 Annual Meeting of Stockholders (the “2018“2019 Meeting”) and any adjournment or postponement of the 20182019 Meeting. The background information in this Proxy Statement has been supplied to you at the request of the Board to help you decide how to vote and to provide information on the Company’s corporate governance and compensation practices. References in this document to “the Company” and “DowDuPont” mean DowDuPont Inc., to “Dow” means The Dow Chemical Company, and to “DuPont” means E. I. du Pont de Nemours and Company. This Proxy Statement is first being distributed to stockholders on or about March 16, 2018.April 29, 2019.

Vote Your Shares in Advance

You may vote your shares by internet, telephone or signing and returning the enclosed proxy or other voting instruction form.Your shares will be voted only if the proxy or voting instruction form is properly executed and received by the independent Inspectors of Election prior to the 20182019 Meeting. Except as provided below with respect to shares held in employee savings plans, if no specific instructions are given by you when you execute your voting instruction form, as explained on the form, your shares will be voted as recommended by the Board.

You may revoke your proxy or voting instructions at any time before their use at the 20182019 Meeting by sending a written revocation, by submitting another proxy or voting form on a later date, or by attending the 20182019 Meeting and voting in person. No matter which voting method you choose, however, you should not vote any single account more than once unless you wish to change your vote. Be sure to submit votes for each separate account in which you hold DowDuPont common stock.

Confidential Voting

The Company maintains vote confidentiality. Proxies and ballots of all stockholders are kept confidential from the Company’s management and Board unless disclosure is required by law and in other limited circumstances. The policy further provides that employees may confidentially vote their shares of Company stock held by employee savings plans, and requires the appointment of an independent tabulator and Inspectors of Election for the 20182019 Meeting.

Dividend Reinvestment Plan Shares and Employee Savings Plan Shares

If you are enrolled in the direct stock purchase and dividend reinvestment plan administered by Computershare Trust Company, N.A. (the “Computershare CIP”), the DowDuPont common stock owned on the record date by you directly in registered form, plus all shares of common stock held for you in the Computershare CIP, will appear together on a single proxy voting form. If no instructions are provided by you on an executed proxy voting form, your Computershare CIP shares will be voted as recommended by the Board.

| 1 | |||||||

VOTING AND ATTENDANCE PROCEDURES (continued)

Participants in various employee savings plans including The Dow Chemical Company Employees’ Savings Plan and the DuPont Retirement Savings Plan (each a “Plan” or collectively the “Plans”), will receive a voting instruction form. Your executed form will provide voting instructions to the respective Plan Trustee (Fidelity Management Trust Company for the Dow Plan and Merrill Lynch, Pierce, Fenner & Smith, Incorporated for the DuPont Plan).plan trustee. If no instructions are provided, the Trusteesplan trustees and/or administrators offor the Plansrelevant employee savings plan will vote the respective Plan shares according to the provisions of each Plan.the relevant employee savings plan. To allow sufficient time for voting, your voting instructions must be received by 11:59 P.M. Eastern Time on AprilJune 20, 2018, or, if you are voting via the Internet or by phone, by 11:59 P.M. Eastern Time on April 22, 2018. Accordingly, you2019. You may not vote your Plan shares held in an employee savings plan in person at the Annual Meeting.

| ||||||||

VOTING AND ATTENDANCE PROCEDURES (continued)

DowDuPont Shares Outstanding and Quorum

At the close of business on the record date, FebruaryApril 26, 2018,2019, there were 2,325,945,2192,246,370,461 shares of DowDuPont common stock outstanding and entitled to vote. Each share of common stock is entitled to one vote. The holders of at least 50% of the issued and outstanding shares of common stock entitled to vote that are present in person or represented by proxy constitute a quorum for the transaction of business at the 20182019 Meeting.

For Agenda Item 1: Election of Directors, each nominee must receive more FOR votes than AGAINST votes in order to be elected. For Agenda Item 3: Advisory Resolutions on the Frequency of Future Advisory Votes to Approve Executive Compensation, the frequency (every one year, every two years or every three years) that receives the most FOR votes will be approved. For all other Agenda Items to be presented for a vote at the 20182019 Meeting (2 and 4 through 9)7), each such item must receive more FOR votes than AGAINST votes in order to be approved. Abstentions and brokernon-votes will be included in determining the presence of a quorum at the 20182019 Meeting, but will not be counted or have an effect on the outcome of any matter except as specified below with respect to Agenda Item 4. 3.

Brokernon-votes occur when a person holding shares through a bank or broker, meaning that their shares are held in a nominee name or beneficially through such bank or broker, does not provide instructions as to how to vote their shares and the bank or broker is not permitted to exercise voting discretion. Under New York Stock Exchange (“NYSE”) rules, your bank or broker may vote shares held in beneficial name only on Agenda Item 4:3: Ratification of the Appointment of the Independent Registered Public Accounting Firm, without instruction from you, but may not vote on any other matter to be voted on at the 20182019 Meeting. A list of stockholders of record entitled to vote shall be open to any stockholder for any purpose relevant to the 20182019 Meeting for ten days before the 20182019 Meeting, during normal business hours, at the Office of the Corporate Secretary.

Proxy Solicitation on Behalf of the Board

The Board is soliciting proxies to provide an opportunity for all stockholders to vote, whether or not the stockholders are able to attend the 20182019 Meeting or an adjournment or postponement thereof. Directors, officers and employees may solicit proxies on behalf of the Board in person, by mail, by telephone or by electronic communication. The proxy representatives of the Board will not be specially compensated for their services in this regard.

DowDuPont has retained Innisfree M&A Incorporated to aid in the solicitation of stockholders (primarily brokers, banks and other institutional investors) for an estimated fee of $25,000, plus reasonable expenses. Arrangements have been made with brokerage houses, nominees and other custodians and fiduciaries to send materials to their principals, and their reasonable expenses will be reimbursed by DowDuPont on request. The cost of solicitation will be borne by the Company.

Attending the 20182019 Meeting

An approved form of proof of stock ownership is necessary to attend the 20182019 Meeting. If you hold your shares through a bank or broker, you will need proof of record date ownership for admission to the 20182019 Meeting, such as a letter from the bank or broker. In addition, such holders who wish to vote in person at the 20182019 Meeting must obtain a “legal proxy” from the bank, broker or other holder of record that holds their shares in order to be entitled to vote at the 20182019 Meeting.

Since seating is limited, the Board has established the rule that only stockholders or one person holding a proxy for any stockholder or account (in addition to those named as Board proxies on the proxy forms) may attend.

All stockholders and proxy holders wishing to attend the 20182019 Meeting should bring and present valid government issued photo identification for admittance. Proxy holders will also be asked to present credentials for admittance.

Please note that cameras, sound or video recording equipment, or other similar equipment, electronic devices, large bags or packages will not be permitted in the Annual2019 Meeting.

If you are unable to attend the 2018 Meeting in person, please listen to the live audio webcast or the replay after the event, atwww.dow-dupont.com/investors.

Other Matters

The Board does not intend to present any business at the 20182019 Meeting that is not described in this Proxy Statement. The enclosed proxy or other voting instruction form confers upon the designated persons the discretion to vote the shares represented in accordance with their best judgment. Such discretionary authority extends to any other properly presented matter. The Board is not aware of any other matter that may properly be presented for action at the 20182019 Meeting.

| 2 |   | |||||||

Strong corporate governance is an integral part of both Historical Dow’s and Historical DuPont’s historic core values, and, as a result, DowDuPont is committed to applying the same sound corporate governance and leadership principles and practices. Within this section, you will find information about the Board and its governance structure and processes. This section provides an overview of the current corporate governance structure of DowDuPont which was modified in connection with the separations and will be in place for DuPont going forward.

DowDuPont Board Corporate Governance Guidelines

The Corporate Governance Guidelines form an important framework for the Board’s corporate governance practices and assist the Board in carrying out its responsibilities. The Board reviews these guidelines periodically to consider the need for amendments or enhancements. Among other things, these guidelines delineate the Board’s responsibilities, leadership structure, independence, qualifications, election, annual self-evaluation, and access to management and advisors.

We invite you to visit the Company’s website atwww.dow-dupont.com/investors/corporate-governance to review the following governance documents:

Director Code of Conduct

Employee Code of Conduct

Amended and Restated Certificate of Incorporation

Third Amended and Restated Bylaws

Corporate Governance Guidelines

Code of Financial Ethics

Conflict Minerals and Human Rights Reports and Policies

Board Composition

As of the date of the Proxy Statement the Board was composed of the Directors listed below. As indicated in the table below, certain of the current Directors are expected to resign in connection with the Corteva Distribution and become directors of Corteva and certain of the current Directors are expected to continue as Directors of DuPont and are nominated forre-election at the 2019 Meeting.

| Expected Board Affiliation Following Corteva Distribution | ||||||

Current DowDuPont Directors | Corteva | DuPont | ||||

Lamberto Andreotti | X | |||||

Edward D. Breen | X | X | ||||

Robert A. Brown | X | |||||

Alexander M. Cutler | X | |||||

Lois D. Juliber | X | |||||

Lee M. Thomas | X | |||||

Patrick J. Ward | X | |||||

Following the Corteva Distribution and prior to the 2019 Meeting, the following individuals are expected to be appointed to the Board of DuPont Political Policy(prior to the Corteva Distribution, DowDuPont): Ruby R. Chandy, Franklin K. Clyburn, Jr., Terrence R. Curtin, C. Marc Doyle, Eleuthère I. du Pont, Rajiv L. Gupta, Luther C. Kissam, Frederick M. Lowery, Raymond J. Milchovich and Engagement ReportsSteven M. Sterin (collectively, the “New DuPont Directors”). Mr. Milchovich previously served on the DowDuPont Board from September 1, 2017 until July 1, 2018. These ten directors, as well as Messrs. Breen and PoliciesCutler, will stand forre-election at the 2019 Meeting.

| 3 | |||||||

CORPORATE GOVERNANCE (continued)

Director Independence

The Board has assessed the independence of eachnon-employee Director in accordance with the standards of independence of the NYSE, SEC rules and as described in the Corporate Governance Guidelines. Based upon these standards, the Board has determined that the following fourteen membersall of the Boardcurrent Directors other than Mr. Breen are independent Directors: Lamberto Andreotti, James A. Bell, Robert A. Brown, Alexander M. Cutler, Jeff M. Fettig, Marillyn A. Hewson, Lois D. Juliber, Raymond J. Milchovich, Paul Polman, Dennis H. Reilley, James M. Ringler, Ruth G. Shaw, Lee M. Thomas and Patrick J. Ward.independent. These independent Directors constitute a “substantial majority” of the Board, consistent with Board policy. In addition, the Board has determined that each of the nominees for Director other than Messrs. Breen and Doyle is independent. The CorporateNomination and Governance Committee, as well as the Board, will annually review relationships that Directors may have with the Company and members of management to make a determination as to whether there are any material relationships that would preclude a Director from being independent.

All members of the Audit, People and Compensation, and CorporateNomination and Governance Committees are independent Directors under the Corporate Governance Guidelines and applicable regulatory and listing standards.

The Board had previously determined that the following individuals who served as Directors on the DowDowDuPont Board until the effective date of the Merger TransactionDow Distribution were also independent Directors: Ajay Banga, Jacqueline K. Barton, James A. Bell, Richard K. Davis, Mark Loughridge,Jeff M. Fettig and Robert S. (Steve) Miller.Ruth G. Shaw. In addition, the Board had previously determined that each of Dennis H. Reilley, who retired from the Board on December 31, 2018, Marillyn A. Hewson, who retired from the Board on March 31, 2019, Paul Polman, who retired from the Board on April 1, 2019, and James M. Ringler, who retired from the Board on April 1, 2019, was an independent Director.

Board Leadership Structure

The Board is responsible for broad corporate policy and overall performance of the Company through oversight of management and stewardship of the Company. Among other duties, the Board appoints the Company’s officers, assigns to them responsibility for management of the Company’s operations, and reviews their performance.

As described in Prior to the Company’s Amended and Restated Bylaws effectivecompletion of the Dow Distribution on April 1, 2019, Jeff Fettig served as of September 11, 2017 (“Bylaws”), Andrew N. Liveris currently serves as thenon-employee Executive Chairman of DowDuPont and Edward D. Breen servesserved as the Chief Executive Officer of DowDuPont. As announced by the Company on March 12, 2018,Mr. Fettig also served as of April 1, 2018, Mr. Liveris will no longer serve as Executive Chairman. Effective April 1, 2018, Jeff M. Fettig will serve as a non-employee Executive Chairman. Following this transition, Mr. Liveris will continue as a Director of DowDuPont through his previously announced retirement from the Company on July 1, 2018. The previous Lead Independent Directors of each of Dow and DuPont serve asCo-Lead Independent DirectorsDirector, along with Alexander M. Cutler. Following the Dow Distribution, Mr. Breen became the Chair and Chief Executive Officer of DowDuPont and Mr. Cutler became the Board with responsibilities set forth in the Corporate Governance Guidelines. Further detail on the responsibilities of those roles follows.

| ||||||||

CORPORATE GOVERNANCE (continued)

sole Lead Independent Director.

Executive ChairmanChair

The Executive ChairmanChair has the lead responsibility for chairing the Board. The Executive Chairman hasChair presides at all meetings of the following corporate-wide responsibilities:

The Executive Chairman has allstockholders and the Board and performs such other duties and may exercise such other powers andas may perform such other duties as mayfrom time to time be assigned by the Board from time to time.Bylaws or by the Board.

Chief Executive Officer

The Chief Executive Officer of DowDuPont reports to the Board and has general charge and supervision of the following corporate-wide responsibilities:

business of the Company subject to the direction of the Board. The Chief Executive Officer performs all duties and has all powers that are commonly incident to the office of chief executive or that are delegated to such other powers and may perform such other duties as may be assignedofficer by the Board from time to time.Board.

Co-Lead Independent Director Roles

The Board hasCo-Lead Independent Directors, designated in accordance with the Bylaws, whose shared responsibilities are to:

Committees

Committees perform many important functions. The responsibilities of each Committee are stated in the Bylaws and in their respective Committee charters. The Board, upon the recommendation of the CorporateNomination and Governance Committee, elects members to each Committee and has the authority to change Committee chairs, memberships and the responsibilities of any Committee as set forth in the Bylaws.

The Board currently has four Standing CommitteesCommittees: (i) Audit Committee; (ii) Nomination and three Advisory Committees (individually a “Committee”Governance Committee; (iii) People and collectively the “Committees”Compensation Committee; and (iv) Sustainability, Public Policy, Environment and Health and Safety Committee (“SPEH&S Committee”):.

| ||

|

| |

|

| |

|

| |

|

| 4 |   | |||||||

CORPORATE GOVERNANCE (continued)

A brief description of the responsibilities of the Committees are as follows:

Standing Committees

Audit Committee

All members of the Audit Committee are independent Directors under the Board’s Corporate Governance Guidelines and applicable regulatory and listing standards.

The Board has determined that all members of the Audit Committee are “audit committee financial experts” within the meaning of applicable SEC rules. Held 11 meetings during 2018. | • Nominates, engages and replaces, as appropriate, the Company’s independent registered public accounting firm, subject to stockholder ratification, to audit the Company’s Consolidated Financial Statements.

• Reviews and approves the Audit Committee

• Provides oversight on the external reporting process and the adequacy of the Company’s internal controls.

• Reviews effectiveness of the Company’s systems, procedures and programs designed to promote and monitor compliance with applicable laws and regulations and receives prompt reports on any compliance matter that could adversely impact the Company’s external reporting process or adequacy of internal controls.

• Reviews the scope of the audit activities of the independent registered public accounting firm and the Company’s internal auditors and appraises audit efforts of both.

• Reviews services provided by the Company’s independent registered public accounting firm and other disclosed relationships as they bear on the independence of the Company’s independent registered public accounting firm.

• Establishes procedures for the receipt, retention and resolution of complaints regarding accounting, internal controls or auditing matters.

A Summary of the

| |

All members of the |

|

| ||||||||

CORPORATE GOVERNANCE (continued)

Held four meetings during 2018. | • Develops and recommends to the Board a set of corporate governance guidelines for the Company. • Establishes the process for identifying and evaluating director nominees, determines the qualifications, qualities, skills and other expertise required to be a director, and recommends to the Board nominees for election to the Board.

• Monitors the functioning of Board Committees.

• Oversees the Board’s new director orientation program.

• Oversees the annual assessment of the Board and its Committees.

• Oversees the Company’s corporate governance practices, including reviewing and recommending to the Board for approval any changes to the Company’s Code of Conduct and Code of Financial Ethics, Certificate of Incorporation, Bylaws and Committee charters.

• Oversees the Company’s

|

| 5 | |||||||

CORPORATE GOVERNANCE (continued)

People and All members of the People and Compensation Committee are independent Directors under the Board’s Corporate Governance Guidelines and applicable regulatory and listing standards. Held five meetings during 2018. | • Retains any compensation consultants that the Committee, in its sole discretion, deems appropriate to fulfill its duties and responsibilities; the Committee sets the compensation and oversees the work of the consultants, including approval of an applicable executive compensation peer group. • Assesses current and future senior leadership talent for Company officers. • Assists the Board in the CEO succession planning process. • Reviews and approves the Company’s programs for executive development, performance and skills evaluations. • Conducts an annual review of the Company’s diversity talent and diversity representation on the slate for key positions. • Reviews and approves the goals and objectives relevant to the CEO’s compensation, oversees the performance evaluation of the CEO based on such goals and objectives and, together with the other independent members of the Board of Directors, determines and approves the CEO’s compensation based on this evaluation. • Reviews and approves all compensation and employment arrangements, including severance agreements, of the Company’s executive officers and named executive officers other than the CEO. • Reviews the Company’s

• Works with management to develop the Compensation Discussion and Analysis and other compensation disclosures for inclusion in the Company’s Annual Report on Form10-K, annual meeting Proxy Statement or any other filings with the SEC. • Considers the voting results of anysay-on-pay or related stockholder proposals. • Recommendsnon-employee directors’ compensation to the Board of Directors. | |

SPEH&S Committee Held one meeting during 2018. | • Assesses the effectiveness of, and advises the Board on, corporate responsibility programs and initiatives, including the Company’s public policy, environment, health and safety (“EH&S”) and sustainability policies and programs and matters impacting the Company’s public reputation. • Oversees and advises the Board • Reviews the Company’s public

|

Advisory Committees

The Advisory Committees were established to oversee the business and affairs of each of DowDuPont’s Agriculture, Materials Science and Specialty Products divisions in preparation for the Intended Business Separations. Each Advisory Committee is responsible for overseeing the business and affairs of its respective division including:

• Assesses the Company’s EH&S and sustainability policies and performance and makes recommendations to the Board and the management of DowDuPont with regard to the same.

• Reviews and |

| 6 |   | |||||||

CORPORATE GOVERNANCE (continued)

Committee Membership

The following chart showsA list of the current Directors and their respective Committee membership and the number of meetings that each Committee held in 2017. The total number of Standing Committee meetingsmemberships is noted for Dow from January 1, 2017 until the closing of the Merger Transaction on August 31, 2017, and for DowDuPont from September 1, 2017 until December 31, 2017.

| Standing Committees | Advisory Committees | |||||||||||||||

Director | Audit | Compensation | Corporate Governance | Environment, Health, Safety and Technology | Agriculture | Materials Science | Specialty Products | |||||||||

Lamberto Andreotti*

|

X |

X | ||||||||||||||

James A. Bell*

|

CH |

X | ||||||||||||||

Edward D. Breen – Chief Executive Officer

|

CH |

CH |

X |

CH | ||||||||||||

Robert A. Brown*

|

X |

X | ||||||||||||||

Alexander M. Cutler*

|

CH |

X |

A |

A | ||||||||||||

Jeff M. Fettig*

|

CH |

X | ||||||||||||||

Marillyn A. Hewson*

|

X |

X |

A | |||||||||||||

Lois D. Juliber*

|

CH |

X | ||||||||||||||

Andrew N. Liveris – Executive Chairman

|

CH |

X |

CH |

X | ||||||||||||

Raymond J. Milchovich*

|

X |

X |

A | |||||||||||||

Paul Polman*

|

X |

X | ||||||||||||||

Dennis H. Reilley*

|

CH |

X |

A | |||||||||||||

James M. Ringler*

|

X |

X | ||||||||||||||

Ruth G. Shaw*

|

X |

X | ||||||||||||||

Lee M. Thomas*

|

X |

X | ||||||||||||||

Patrick J. Ward*

|

CH |

X | ||||||||||||||

Number of Meetings in 2017

|

Dow (17 total)

|

6 |

4 |

4 |

3 |

n/a |

n/a |

n/a | ||||||||

DowDuPont (14 total)

|

3 |

2 |

2 |

1 |

2 |

2 |

2 | |||||||||

* = Independent CH = Chairman or, as applicable,Co-Chairman A = Additional Ex Officio Attendee

In addition, Advisory Committee members may participate in other Advisory Committee meetings as an attendee. Such attendees may not vote or be counted for quorum purposes. Advisory Committees also include ex officio members from the legacy Dow and legacy DuPont Boards who are not serving on the Board, as well as additional members who participate in an ex officio capacity as appointed by the Board to provide the Advisory Committees with the business context and knowledge needed to ensure an efficient and timely transition for the Intended Business Separations. Such ex officio members may not vote or be counted for quorum purposes.

Additional Information about the Advisory Committees

Agriculture Advisory Committee

The Agriculture Advisory Committee is comprised of (i) members of the Board who were designated by the DuPont board, (ii) the Executive Chairman of DowDuPont, (iii) the Chief Executive Officer of DowDuPont, and (iv) former members of the DuPont board who are not members of the DowDuPont Board and who serve in an ex officio capacity by virtue of their prior service on the DuPont board.

Materials Science Advisory Committee

The Materials Science Advisory Committee is comprised of (i) members of the Board who were designated by the Dow board, (ii) the Executive Chairman of DowDuPont, (iii) the Chief Executive Officer of DowDuPont, and (iv) former members of the Dow board who are not members of the DowDuPont Board and who serve in an ex officio capacity by virtue of their prior service on the Dow board.below:

| Committees | ||||||||

| Director |  | Nomination and Governance | People and Compensation | SPEH&S Committee | ||||

Lamberto Andreotti*# | X | |||||||

Edward D. Breen – Chief Executive Officer | CH | |||||||

Robert A. Brown*# | X | |||||||

Alexander M. Cutler* | X | CH | ||||||

Lois D. Juliber*# | CH | |||||||

Lee M. Thomas*# | X | |||||||

Patrick J. Ward*# | CH | |||||||

* = Independent CH = Chair # = Expected to Resign from the Board at the time of the Corteva Distribution

CORPORATE GOVERNANCE (continued)Following the Corteva Distribution and the appointment of the New DuPont Directors, the Board Committees are expected to be composed as follows:

| Committees | ||||||||

| Director | Audit | Nomination and Governance | People and Compensation | SPEH&S Committee | ||||

Edward D. Breen

| ||||||||

Ruby R. Chandy* | X | CH | ||||||

Franklin K. Clyburn, Jr.* | X | X | ||||||

Terrence R. Curtin* | X | X | ||||||

Alexander M. Cutler* | CH | X | ||||||

C. Marc Doyle | ||||||||

Eleuthère I. du Pont* | X | X | ||||||

Rajiv L. Gupta* | CH | X | ||||||

Luther C. Kissam* | X | X | ||||||

Frederick M. Lowery* | X | X | ||||||

Raymond J. Milchovich* | X | X | ||||||

Steven M. Sterin* | CH | X | ||||||

* = Independent CH = Chair

Specialty Products Advisory Committee

The Specialty Products Advisory Committee is comprised of (i) the Executive Chairman of DowDuPont, (ii) the Chief Executive Officer of DowDuPont, (iii) members of the Board as may be agreed on by the Executive Chairman and the Chief Executive Officer of DowDuPont, (iv) former members of the Dow or DuPont boards who are not members of the DowDuPont Board and who serve in an ex officio capacity by virtue of their prior service on the Dow or DuPont board, and (v) any additional members who participate in an ex officio capacity as appointed by the Executive Chairman and the Chief Executive Officer.

Decision Making and Administration

To the extent there are any disagreements between or among the Advisory Committees regarding the determinations about the capital structure of the three divisions, the matter shall be submitted to a reconciliation committee, consisting of the Chief Executive Officer, the Executive Chairman, and theCo-Lead Independent Directors, for resolution. To the extent the reconciliation committee is unable to come to a determination, a majority of the Board shall make the determination.

Pursuant to the Bylaws, the Board will have the authority to approve the Intended Business Separations or may determine to abandon, by a majority vote, the exploration or pursuit of a separation of the Agriculture division, Materials Science division or Specialty Products division, respectively. In the event that the separation of any division is consummated, the Advisory Committee with respect to such division shall be dissolved, with it being anticipated that its members would continue as members of the Board of Directors of the separated entity, and the provisions in the Bylaws with respect thereto shall be of no further force and effect. To the extent the Board determines to abandon one or more of the anticipated separations, the Advisory Committees may be dissolved at any time following thetwo-year anniversary of the consummation of the merger.

Provisions of the Bylaws regarding the Executive Chairman and Chief Executive Officer, the DowDuPont Board and the Advisory Committees described above may only be modified, amended or repealed, and Bylaw provisions inconsistent with such matters may only be adopted, by an affirmative vote of at least 66 2/3% of: (i) the Board or (ii) the holders of all shares of capital stock of DowDuPont then entitled to vote on such matters.

Board’s Role in the Oversight of Risk Management

The Board is responsible for overseeing the overall risk management process for the Company. Risk management is considered a strategic activity within the Company and responsibility for managing risk rests with executive management while the Standing Committees and the Board as a whole participate in the oversight of the process. Specifically, the Board has responsibility for overseeing the strategic planning process and reviewing and monitoring management’s execution of the corporate and business plan, and each Standing Committee is responsible for oversight of specific risk areas relevant to their respective charters. This process includes an assessment of potential cyber-attacks and the ongoing review of the Company’s comprehensive cyber security program.

| 7 | |||||||

CORPORATE GOVERNANCE (continued)

The oversight responsibility of the Board, and Standing Committees is enabled by an enterprise risk management model and process implemented by management that is designed to identify, assess, manage and mitigate risks. The Audit Committeeacting through its committee structure, is responsible for overseeing that management implements and follows this risk management process and for coordinating the outcome of reviews by the other Standing Committees in their respective risk areas.

| Area(s) of Risk Management Oversight Responsibility | |

|

| |

Audit Committee |

| |

|

| |

People and Compensation Committee

| The Company’s executive compensation practices | |

SPEH&S Committee |

|